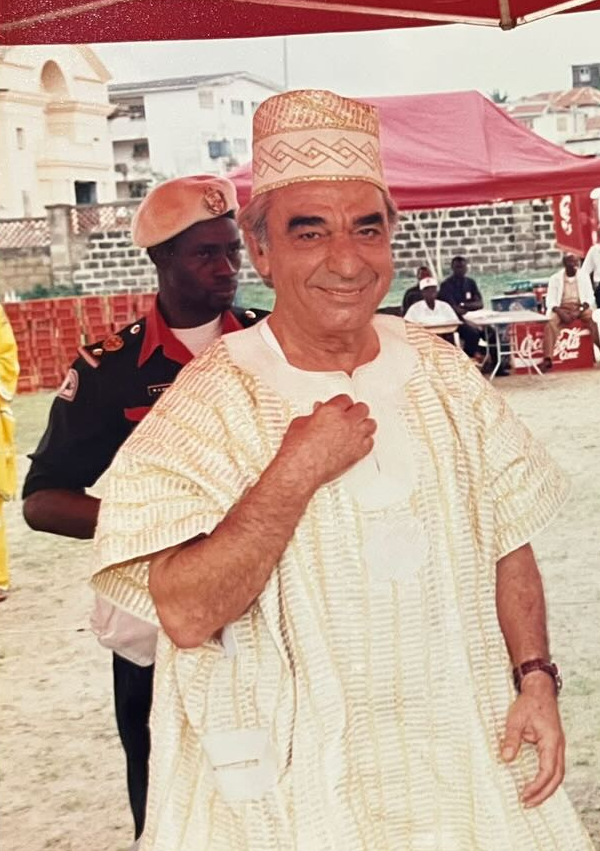

Roman Abramovich, the sanctioned Russian oligarch, could face a staggering tax bill of up to £1bn as evidence reveals a failed plan to dodge taxes on hedge fund investments, according to leaked documents reviewed by the BBC. These investments, valued at $6bn (£4.7bn), were funneled through companies in the British Virgin Islands but appear to have been controlled from the UK, making them liable for UK taxation.

The investigation highlights Abramovich's funding of Chelsea FC, where some money from tax-evaded investments can be traced back. His legal team insists he acted on sound tax advice and wasn't aware of any tax liabilities. Meanwhile, Labour MP Joe Powell has urged an investigation by HM Revenue and Customs (HMRC) to reclaim potential funds for public services.

Central to this scheme is Eugene Shvidler, a former director of Chelsea FC, who is facing sanctions due to close ties with Abramovich. Tax experts suggest evidence points to Shvidler making key investment decisions in the UK, indicating that these profits should have been taxed domestically.

As investigations continue, the implications for Abramovich—who once made significant profits through questionable dealings—and his past financial ties to Chelsea FC, are more scrutinized than ever.